Home Mortgage Brokers That Save You Time and Cash

In the complicated landscape of mortgage funding, the role of home loan brokers emerges as an essential possession for borrowers looking for performance and savings. These specialists not only streamline the application procedure yet likewise take advantage of their industry connections to discover one of the most positive financing options tailored to individual demands. By navigating the ins and outs of lender negotiations and specific programs, brokers can significantly boost financial choices. Comprehending the full degree of their benefits and exactly how to choose the best broker could make all the difference in your monetary journey. What factors should you consider before making this vital option?

Benefits of Making Use Of a Mortgage Broker

Frequently, homebuyers overlook the advantages of engaging a home loan broker during the financing process. One considerable advantage is the broker's capacity to supply accessibility to a vast range of car loan items from multiple loan providers. This expansive network allows buyers to contrast rates, terms, and problems, ultimately causing more favorable financing choices tailored to their distinct financial circumstances.

Additionally, home loan brokers possess substantial market understanding and competence. They can browse the complexities of the mortgage market, making certain that property buyers comprehend the subtleties of each choice available. This experience can be indispensable in avoiding typical challenges and pricey blunders that may emerge during the lending procedure.

Lastly, home mortgage brokers often discuss in support of their customers, leveraging their connections with loan providers to safeguard more positive terms. This campaigning for can result in far better passion rates and decreased charges, ultimately conserving buyers cash over the life of the car loan. Engaging a home loan broker can be a wise decision for numerous possible homeowners.

How Home Loan Brokers Job

Many property buyers might wonder just how home mortgage brokers facilitate the financing procedure. Home mortgage brokers work as middlemans in between consumers and lending institutions, streamlining the complex journey of securing a home loan. Brokers examine the economic situation of their customers, collecting crucial details such as income, debt background, and specific finance requirements.

Once the customer's account is developed, brokers take advantage of their substantial network of lenders to find appropriate home mortgage choices. They evaluate different loan products, comparing passion prices, terms, and problems to determine the very best suitable for the borrower's needs (Omaha refinance home loan). This experience allows brokers to give customized recommendations, making sure clients are educated concerning their choices

After picking the suitable financing, the mortgage broker helps in completing the essential documents, ensuring that all paperwork is exact and submitted in a prompt way. They likewise work as a liaison between the borrower and the lending institution, addressing any questions or problems that develop throughout the underwriting process.

Eventually, mortgage brokers simplify the funding purchase process, making it extra efficient for property buyers to navigate the intricacies of home loan financing while safeguarding affordable rates and beneficial terms.

Time-Saving Methods

Browsing the article source mortgage procedure can be taxing, however executing efficient time-saving strategies can dramatically improve the experience for property buyers. One crucial method is to engage an experienced home loan broker that can handle the intricacies of the process. Brokers possess a wealth of experience and can quickly recognize suitable lending institutions, decreasing the moment spent looking for mortgage choices.

In addition, preparing necessary documentation in advancement is crucial. Property buyers need to put together financial statements, income tax return, and evidence of earnings beforehand, which will accelerate the application process. Utilizing electronic devices, such as home loan calculators and online pre-approval applications, can additionally conserve important time by giving instant responses and structured communication.

Organizing a clear timeline with certain milestones can further enhance performance. Establishing due dates for acquiring files, finishing applications, and organizing evaluations can maintain the procedure on track - Omaha refinance home loan. Preserving open lines of communication with all events involved-- brokers, lenders, and actual estate agents-- guarantees that inquiries are dealt with quickly and choices are made without delay.

Cost-Saving Techniques

Engaging a home mortgage broker not only simplifies the mortgage procedure but can also lead to substantial price financial savings for property buyers. One of the primary cost-saving techniques used by home loan brokers is their capacity pop over here to access a variety of loan providers and mortgage items. This extensive network frequently results in far better passion prices and terms that may not be offered to private borrowers working out by themselves.

Furthermore, home mortgage brokers have comprehensive knowledge of the marketplace, allowing them to identify unique programs, grants, or rewards that can decrease total loaning expenses. They can likewise aid property buyers understand the subtleties of shutting expenses and fees, possibly discussing lower expenses or finding means to fund them within the car loan.

Furthermore, brokers can aid purchasers in improving their credit report accounts before making an application for a home loan, which can lead to more desirable financing terms. By providing individualized advice and tailored remedies, home mortgage brokers aid guarantee that customers make educated decisions, eventually causing lasting cost savings. In recap, using the proficiency of a mortgage broker not only simplifies the mortgage experience yet also improves the possibility for significant economic benefits.

Selecting the Right Home Loan Broker

Choosing the appropriate mortgage broker is important for a smooth and cost-effective home funding experience. A knowledgeable and reliable broker can guide you via the complexities of check out this site obtaining a home mortgage, ensuring you protect the most effective feasible terms customized to your financial situation.

When selecting a home loan broker, begin by assessing their credentials and experience. Look for brokers that hold necessary licenses and have a solid track record in the industry. Reading evaluations and looking for individual referrals can likewise supply valuable insights into their integrity and solution top quality.

Take into consideration the broker's accessibility to a wide variety of lenders. A broker with multiple connections can offer you various loan choices, increasing your possibilities of locating an affordable rate of interest rate and beneficial terms (Omaha refinance home loan). Additionally, ask concerning their charge framework. Transparent brokers will plainly detail their costs and just how they are made up, enabling you to comprehend the total expense of their solutions.

Final Thought

In final thought, involving a home mortgage broker substantially boosts the home mortgage process by improving accessibility to a selection of funding items while using expert advice. Choosing the ideal home mortgage broker is important to taking full advantage of these benefits and making certain a smooth journey through the intricacies of home mortgage funding.

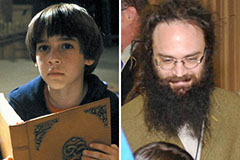

Barret Oliver Then & Now!

Barret Oliver Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!